May 20, 2025

Work-based projects are preparing my students for their futures

Xiaoxuan (Shelly) Ji, Ph.D., CPA

Associate Professor of Accounting

Commonwealth University

Bridging the gap between classroom knowledge and real-world application is a key goal

for any effective educator. I am committed to helping students apply what they have

learned in the classroom to a workplace setting, enabling them to see the relevance

of their studies and perform better in their classes. My goal is to prepare them for

future employment, introduce them to various career opportunities, and assist them

in planning their careers.

Bridging the gap between classroom knowledge and real-world application is a key goal

for any effective educator. I am committed to helping students apply what they have

learned in the classroom to a workplace setting, enabling them to see the relevance

of their studies and perform better in their classes. My goal is to prepare them for

future employment, introduce them to various career opportunities, and assist them

in planning their careers.

I am in my sixth year at Commonwealth University, teaching accounting courses at both

introductory and advanced levels. Work-based learning is a vital aspect of the Zeigler

College of Business culture. Our faculty members highly value this approach and often

incorporate it into classroom instruction and extracurricular activities.

In the fall of 2019, I started incorporating work-based learning into my classroom.

For example, in my federal tax accounting classes, students prepared tax returns,

including Form 1040 for individuals and Form 1120 for corporations. In my intermediate

accounting class, students analyzed the financial statements of Fortune 500 companies.

These hands-on experiences helped students develop the essential skills necessary

for a successful career in accounting.

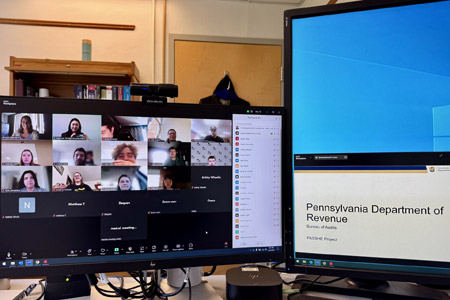

In the fall of 2024, the PASSHE Foundation connected me with the Pennsylvania Department

of Revenue and the Pennsylvania Auditor General. During our meetings, we discussed

ideas for work-based learning, the skills our students need for the workplace, and

potential collaborations with Pennsylvania agencies to enhance our students' education

and prepare them for future employment.

By December 2024, we finalized plans to implement a project in my two accounting classes for the spring semester. The results of these partnerships were outstanding. In my Intermediate Accounting 3 class, representatives from the Pennsylvania Auditor General's office presented their audit responsibilities, emphasizing the importance of government auditing and the audit process. They created an assignment focused on the performance audit of Pennsylvania’s Lottery, which aimed to enhance students' reading, writing, and research skills while providing insights into the role of the Pennsylvania Auditor General.

In my Advanced Federal Tax Accounting class, representatives from the Pennsylvania

Department of Revenue introduced their responsibilities, including sales and use taxes,

and provided valuable tax resources. They developed a simulated case study project

focused on state sales tax research, helping students build essential tax research

skills.

In my Advanced Federal Tax Accounting class, representatives from the Pennsylvania

Department of Revenue introduced their responsibilities, including sales and use taxes,

and provided valuable tax resources. They developed a simulated case study project

focused on state sales tax research, helping students build essential tax research

skills.

These partnerships allow us, as faculty, to identify the skills and competencies that

state agencies desire in future employees. This alignment helps us continuously refine

our curriculum to reflect workplace trends, ensuring our students are better prepared

for employment and maximizing the value of their degrees.

Additionally, many of our students intend to work in Pennsylvania after graduation,

so collaborating with state agencies allows them to learn more about local job opportunities.

By understanding the specific responsibilities of these agencies, students can explore

their interests and begin planning their careers early.

Work-based learning continues to grow across PASSHE, and it’s wonderful to observe

its positive effects on both students and employers. This approach not only enhances

our partnerships but also greatly improves student employability. By connecting classroom

knowledge with real-world experiences, we help students succeed academically while

acquiring essential skills for their future careers. It’s a win-win for everyone involved!