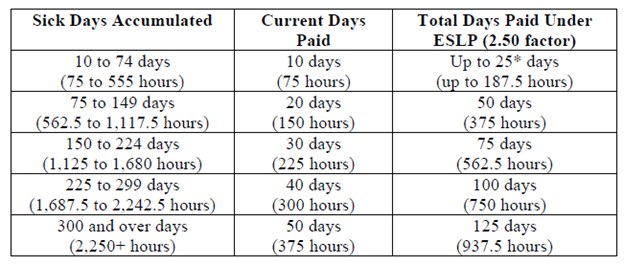

For eligible faculty members, the payout amount under the enhanced sick leave payout

program will be based on your sick leave balance as of the last day of your employment,

in accordance with the schedule below:

*A faculty member may not get paid out for more sick days than they have accumulated.

Yes. Faculty members currently on an approved phased retirement arrangement that are retiring at the end of the 2024/2025 academic year are eligible for the enhanced sick leave payout program. There is no additional action for the faculty member to take to participate.

Eligible faculty members currently on an approved phased retirement arrangement may accelerate their retirement date and participate in the enhanced sick leave payout program by sending a letter to their University President by May 16, 2025, indicating their accelerated retirement date, which must be prior to the start of the Fall 2025 semester (no later than August 22, 2025).

As a result of the unforeseen circumstance, your notice of retirement may be revoked as you do not meet the ESLP program’s eligibility criteria.

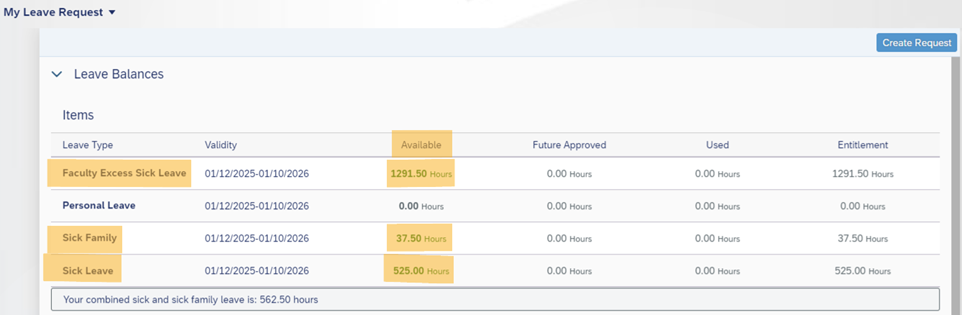

You can view your current sick leave balance by logging into Fiori. Once logged in, click “Leave & Time", then “My Leave Request". The top of the screen illustrates what current leave balances are as of today.

The available balances in the categories of “Sick Leave", “Sick Family Leave", and “Faculty Excess Sick Leave" need to be combined to determine the total sick leave balance to be included in the sick leave payout calculation. In the illustration below, this faculty member's total sick leave balance would be 1,854 hours (1291.50 hours + 37.5 hours + 525 hours), which converts to 247 days. The total hours are divided by 7.5 and rounded down to the whole number of days (any fraction of a day is dropped).

Regular full-time faculty earn 7.5 days (56.25 hours) of sick leave each semester. Tenured part-time faculty earn a pro-rated amount of sick leave, commensurate with their workload (i.e., a part-time faculty member who has a 50% workload earns 3.75 days (28.12 hours) of sick leave each semester).

Faculty members will receive their Spring 2025 sick leave accrual on March 21, 2025.

Your sick leave payout is paid in a lump sum on your final paycheck via direct deposit along with your final pay. Sick leave payouts are taxed at a rate of 22% for federal income tax purposes. State and local taxes are deducted at the normal rates.

Participants enrolled in the Deferred Compensation Plan (457 plan) and/or the Tax-Sheltered Annuity (403b plan) may have federal income tax deferred on their sick leave payout by contributing all or a portion of the payout into their applicable account(s). Current IRS limits may impact the actual amount that can be deferred. For details on deferring your sick leave payout, including the contribution limits, and the process, please refer to this webpage.